Your quick guide to the Insurance Distribution Directive.

The Insurance Distribution Directive (IDD) is a piece of EU legislation that sets regulatory requirements for firms designing and selling insurance products.

The IDD will help us to improve the way we work.

In a nutshell, the IDD is about offering greater protection to consumers everywhere, irrespective of how they buy insurance or who sells it to them.

It’s a piece of legislation that will affect almost every part of your work and ours. IDD applies to insurers, brokers, price comparison websites and any business that’s selling insurance as an ancillary product – such as a car manufacturer, for example.

The IDD should create a level playing field for us all; make us more competitive in a fair way, (which is a positive step for consumers); and stimulate cross-border trade, too. For most firms it will mean making some changes to sales processes, to the work involved with training and individual competence, to the way we disclose remuneration, and to the way we deliver our product oversight and governance.

In particular, the Product Oversight and Governance (POG) rules mean we’ll now be giving you regulated information about the way we develop products, how we approve them, and how we measure their performance.

Our Product Oversight and Governance

Product Oversight and Governance

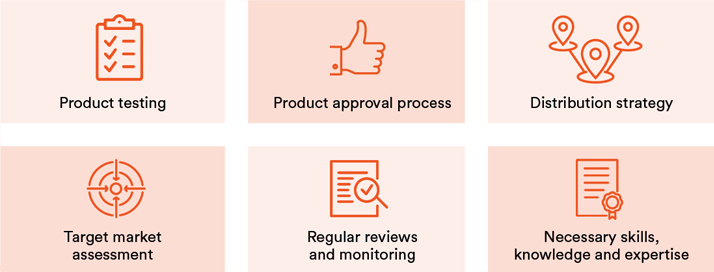

Our approval process will always be appropriate to the complexity of the product and its associated risks. Ultimate responsibility for the process sits with the Ageas UK Executive Team.

- Everyone who’s involved in the design of Ageas products will have the skills needed, the knowledge and the expertise to understand the interests, objectives and characteristics of our customers.

- We’ll identify and define our target markets at an appropriate level given the characteristics and complexity of our products. This will let you see who a product was designed for, as well as for whom it may not be appropriate. See Target Market Statements.

- Our products will all be reviewed on a regular basis to make sure they’re aligned to our customers’ needs. We’ll be asking you for insights that help us to do this.

- We’ll think carefully about the characteristics of our products and who they’re for, when we’re working out how to distribute them. We’ll define those distribution channels in our Target Market Statements.

- All of our products will undergo suitable testing before being launched to a market, to make sure they meet those customers’ needs. This will include reviewing prospective claims ratios to make sure the product can be of value.

Target Market Statements

Our Target Market Statements will give you easy access to information about all of the Ageas products you distribute. This will include having details about:

- The main features and characteristics of each product.

- Who the products are for, and who they wouldn’t be appropriate for.

- The way we intend to distribute the products.

- Any and all potential conflicts of interest.

- Details of the insights we’ll need from you to help us undertake really productive product reviews on a regular basis.

In particular, we’ll need to know about any sales being made outside the target market. We’ll also ask for a summary of any complaints you receive about our products. And of course, if at any time you believe something’s not working – whether that’s the product itself or anything associated with it, or our understanding of consumers’ needs regarding that product – please get in touch with your Broker Account contact to discuss your concerns.